Financial Crimes-Risk Advisory

BSA/AML and OFAC Risk Assessments

Meet FFIEC guidance and evolving regulatory emphasis

- Identify relevant inherent and residual risks based on evaluation of the effectiveness of existing mitigating controls

- Provide customized and consistent methodology driven by technology through our exclusively designed application

Model Validation/Calibration

We use proprietary licensed tools to produce a technological framework for validation that meets the evolving regulatory emphasis and brings efficiency to the process.

- Assessment of conceptual design

- Transaction code mapping

- Process verification

- Outcome analysis - alert and rule verification

Cannabis Banking Program

Turn-Key Risk Management Solution includes:

- Policies, Procedures and Forms

- Technology Based EDD Reviews

- Customized Risk Assessments/Matrices

IT-Cybersecurity - Risk Advisory

Penetration Testing and Vulnerability Assessment

- Identify areas susceptible to outside attacks

- Simulate hacking to assess potential exploits

- Utilize proprietary and commercial tools

- Meet regulatory requirements including DFS Part 500

- Identify risk rated vulnerabilities and required corrective action

Social Engineering

- E-mail Phishing

- Telephone Phishing

- On-Site Visitation

Risk Assessment (IT and Cybersecurity)

- Meets FFIEC, GLBA and DFS Part 500 requirements

- Uses a systematic proprietary process which quantifies inherent and residual risks

- Use of our Subject Matter Experts further enhances the output of the exclusively designed risk application

Credit Risk Advisory

CECL Allowance |

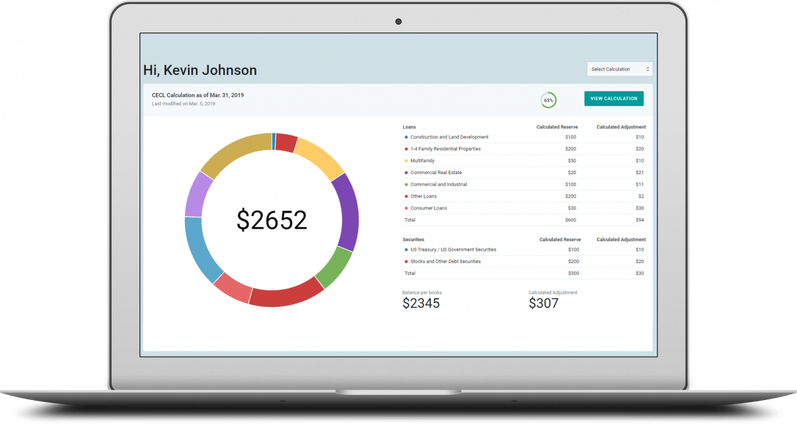

CECL 360TM

|

This secure web based application, powered by TXB, LLC and exclusively licensed by acxell, is ready to help your institution improve the sophistication of your current ALLL calculation, plan for CECL adoption, and implement the new CECL requirements.

Independent Loan review

Our experienced Subject Matter Experts customize an independent loan review function tailored for your specific needs and budget. We use our proprietary methodology to deliver a concise, consistent and transparent loan rating process.

CECL Model Validation

Given the complexity of the CECL calculations, most institutions have recognized the need for a third party software application such as CECL360TM. The validation of the utilization of a CECL application by a financial institution is an essential step to ensure that it is performing as expected. Our experienced and knowledgeable Subject Matter Experts understand the intricacy of a CECL application and use a four prong approach as suggested by Interagency Guidance for all model validations.